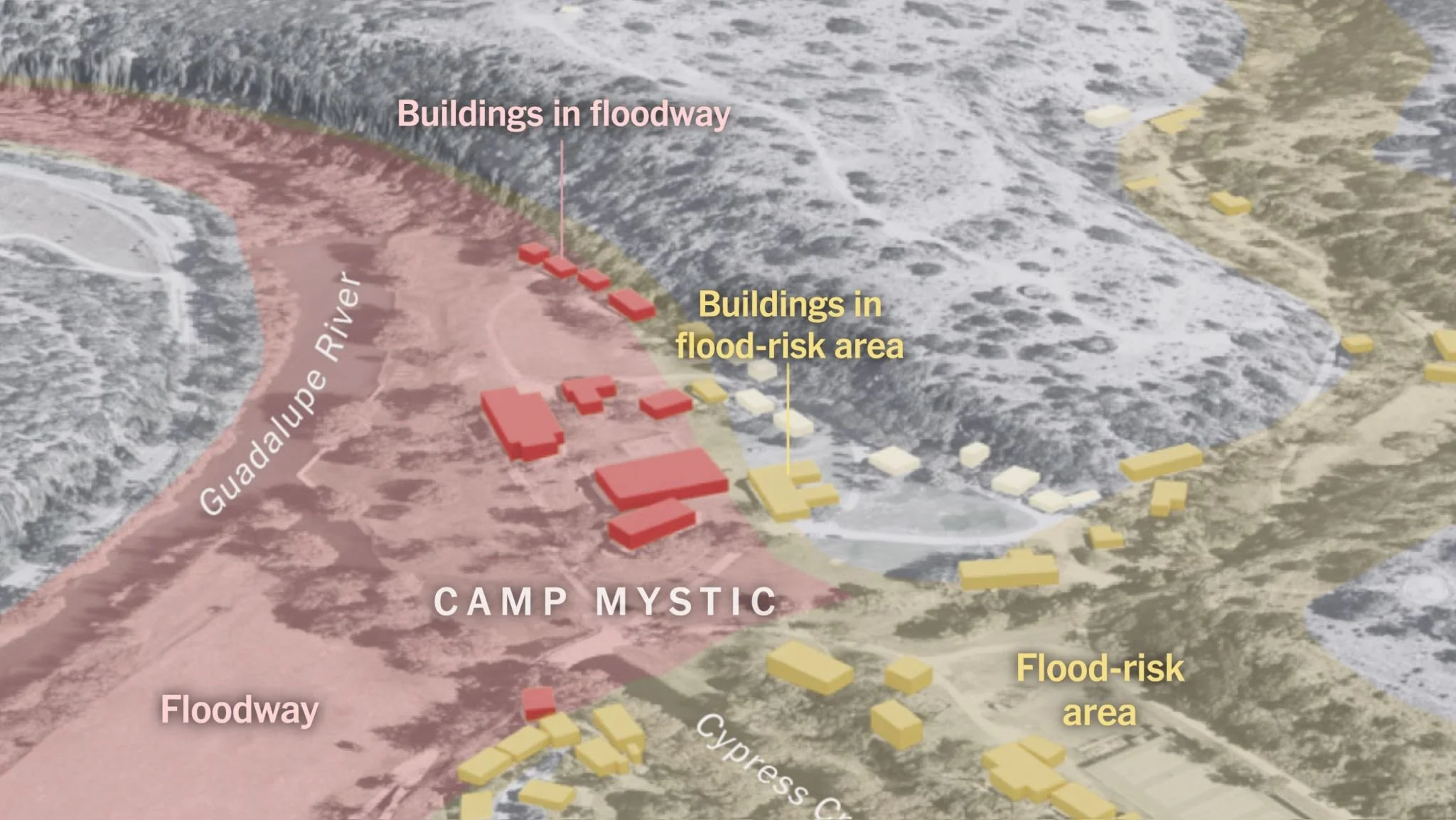

Camp Mystic Guadalupe at the fork of the South Fork Guadalupe River and Cypress Creek in Kerr County, Texas. On July 4, 2025, dangerous flash floods struck the Kerr County area in one of the deadliest floods in US history. Credit: NYTimes

Executive Summary

Previously safe areas are becoming risky, while previously risky areas are becoming life-threatening.

Flood risks have changed and previously safe assets could have quietly become stranded assets. Re-evaluation of existing asset portfolios should be done periodically. It could be just a matter of time before FEMA or insurance changes could re-classify property as a stranded asset.

Steep insurance hikes may be a signal that a property’s physical risk has increased. Instead of dismissing the premium increase as solely a profit driven move, consider the risk implications behind the price hike.

Certain areas that are experiencing high growth (Houston, Tampa, Orlando, South Carolina) overlap with high - and growing - flood risk. Current migration trends may set up for a huge managed retreat cycle. When this occurs, it is unwise to be exposed to this type of risk.

Camp Mystic had previously applied to FEMA to remove flood zone designations from its buildings. The appeals were approved, and the Camp subsequently expanded its campsite within the floodplain. On July 4, 2025, Flash Floods struck Kerr County, Texas and surrounding areas. Over 135 people are dead, with damage estimates nearing $20 Billion.

Behavioral biases may mislead investors into believing historical weather patterns and positive economic conditions will continue indefinitely, while disregarding important long term risks like climate. This ignores important lessons in investing - Past performance is not a guarantee of future results, and Always do Your Own Due Diligence. (It’s not just legalese.)

Background

On the morning of July 4, 2025, extreme flash flooding struck the hill country of Kerr County, Texas, about 100 miles northwest of San Antonio. The floods have been exceptionally devastating and at the time of writing, the death toll stands at 135 persons, with 3 persons still missing. According to Accuweather, the disaster is expected to incur between $18B and $22B in costs for damage and economic loss, including search & recovery efforts, cleanup efforts, insurance claims, and future tourism impacts.

The low lying floodplains in Kerr County by the Guadalupe River are a popular camping and recreation destination, and due to the holiday weekend, there were many people in the area. The wall of flood water struck in the early morning hours, catching most people in its path by surprise. The disaster has been highlighted by its especially devastating effects on Camp Mystic, an all-girls summer camp where at least 27 children and counselors were killed.

At least 8 buildings at Camp Mystic were located in a floodway, the most dangerous part of a floodplain. Credit: NPR

Guadalupe River in Kerr County, TX in 2014. Source: Wikimedia

Flash Flood Contributing Factors:

The July 4 flash floods were extremely severe even for a region nicknamed “Flash Flood Alley”. Officials stated the Guadalupe river rose 26 feet in 45 minutes, reaching the second highest water level on record. A confluence of factors brewed the deadly floods, one of the nation’s deadliest in the last century.

Factors contributing to Extreme Texas Flooding

WEATHER PATTERNS:

Remnants of deep atmospheric moisture from Tropical Storm Barry, which had made landfall in eastern Mexico 5 days earlier, created the rain system creating the flood. Barry itself was weak, but as it died, its circulation drifted northward, bringing with it tropical moisture from Mexico’s Bay of Campeche.

A high atmospheric pressure trough trapped this north-moving moisture’s movement. At the same time, the tilted trough and a mesoscale convective vortex caused rising motion, activating the moisture efficiently into condensation and precipitation. The heavy moisture was therefore activated as the system lingered in the same spot, dumping its rain in a concentrated location instead of along a storm path.

SUSCEPTIBLE GEOGRAPHY

Texas hill country is the first terrain obstacle for moist Gulf air moving northward, which provides conditions for thunderstorm formation.

Steep hills, narrow limestone canyons , and shallow soil depths mean surface water absorption is low and it doesn’t take a lot of rain to create runoff flows. The steep hills and canyons quickly direct rainwater from creeks into rivers.

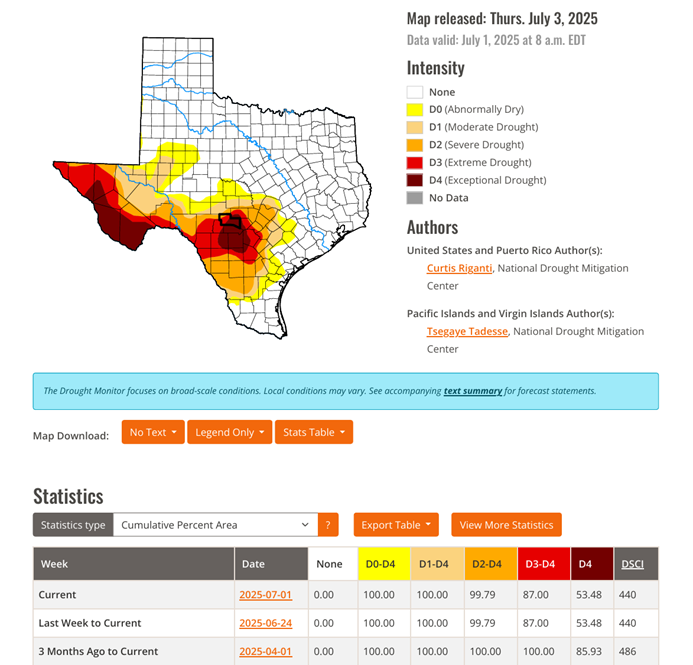

DROUGHT

Kerr County had been experiencing drought conditions, with the July 1, 2025 drought monitor reporting 87% of Kerr County in extreme drought conditions.

Drought conditions can exacerbate flash flooding, since the dry soil cannot efficiently absorb rainfall, and create rapid runoff condition

Drought Monitor - Kerr County, TX as of 7/8/2025 Credit: UNL Drought Monitor

Appeals and Expansions In the Face of Documented Risks

At the center of the tragedy has been the flood’s effects on Camp Mystic, a girls’ summer camp in unincorporated Kerr County. Girls and counselors alike awoke in the middle of the night only to be swept away in the darkness by a wall of water.

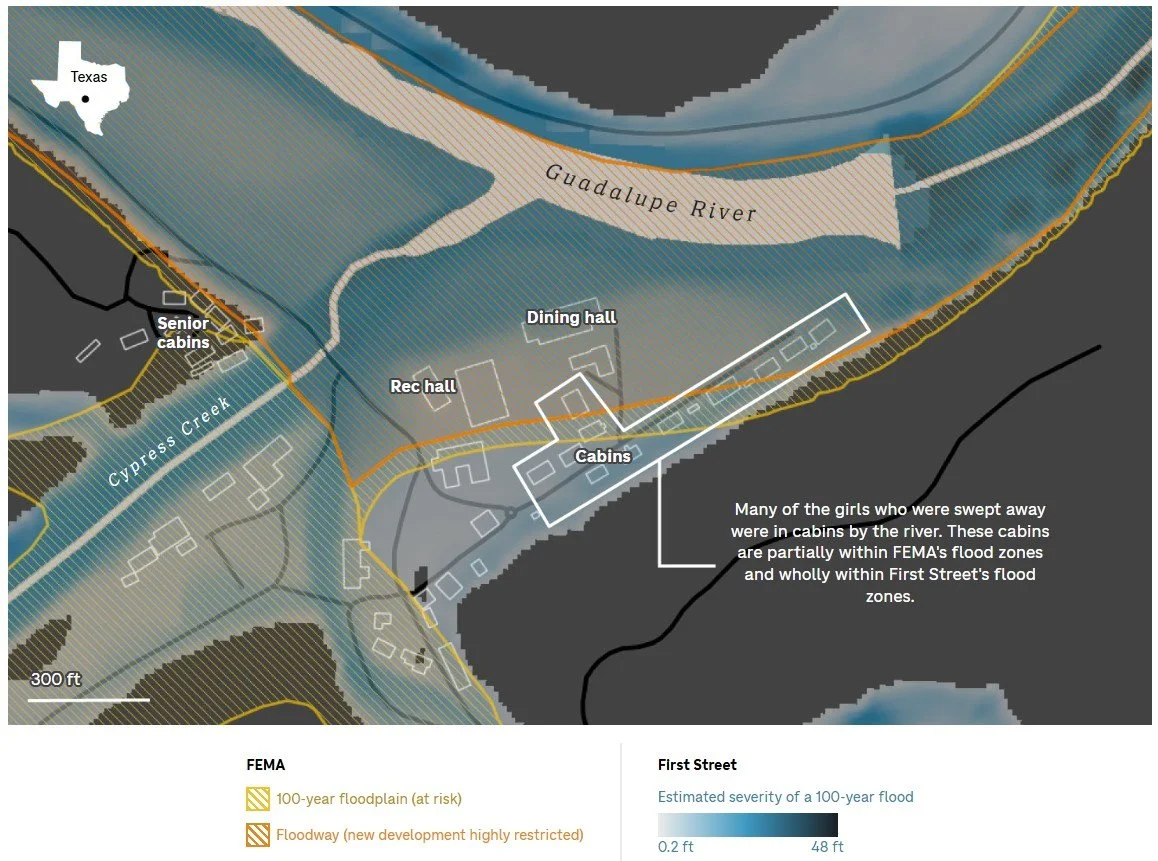

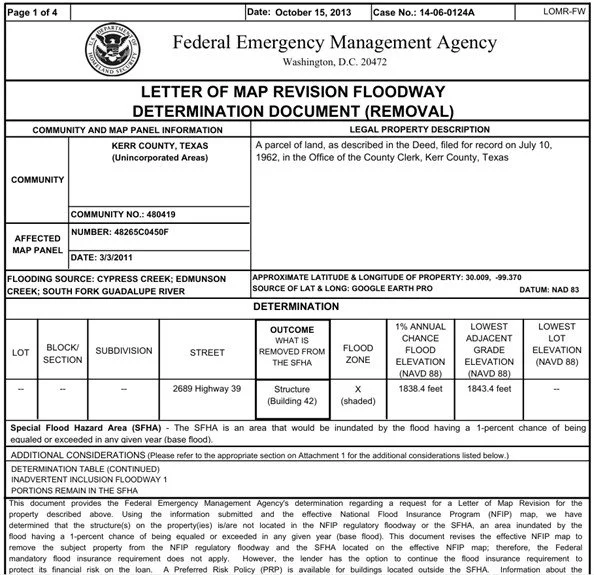

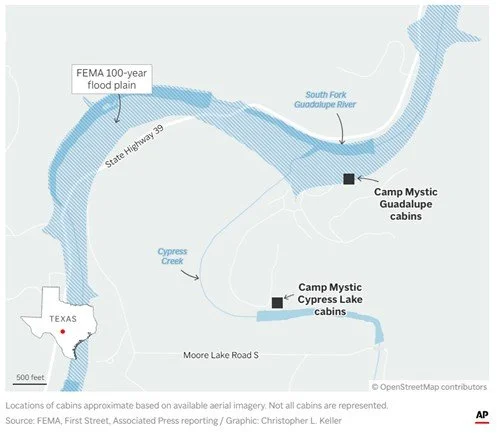

A recent report by the Associated Press found that FEMA granted Camp Mystic multiple appeals to remove its buildings from FEMA’s flood maps, despite many of them being in a 100-year flood zone. In 2011, FEMA published National Flood Insurance maps which included Camp Mystic’s summer camp buildings within its flood zone. Due to the flood zone designation, Camp Mystic would be required to carry flood insurance, and future construction in the area would be subject to more stringent regulation. Subsequently, Camp Mystic appealed the flood zone designation.

FEMA’s approval of a flood map designation appeal at Camp Mystic, issued on October 15, 2013. FEMA would later provide subsequent approvals for additional Camp Mystic buildings in 2019 and 2020. Credit: AP

In 2013, FEMA granted approval to remove some 15 buildings from its flood map designation at Camp Mystic Guadalupe, a 99-year old site on low lying terrain nicknamed “the flats”. Based on FEMA’s maps, about 12 buildings were fully within the 100-year flood plain prior to any appeals. Subsequently, in 2019 and 2020, FEMA removed an additional 15 structures from flood zone designation - these buildings were at Camp Mystic Cypress, an expansion location whose cabins opened in 2020.

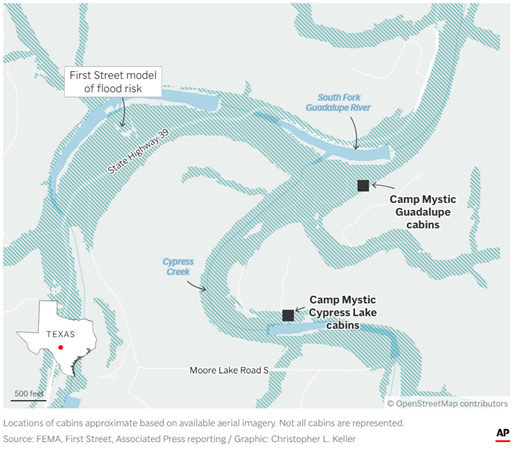

According to First Street, a leading climate data firm, FEMA flood insurance maps can underestimate flood risks because they fail to include the effects of rain on streams and creeks. First Street’s modelled maps, which do include precipitation on creeks and runoff, appear to show both Camp Mystic Guadalupe and Cypress Creek completely within the 100-year flood zone. Due to the storm’s excessive rainfall and region’s drought runoff conditions, the FEMA flood maps did not capture severity anywhere near the actual scale of the July 4 flash floods.

FEMA’s 100-year floodplain map showed Camp Mystic Guadalupe partially within the flood zone. Credit: AP

First Street’s flood risk model shows a much larger flood zone area at Camp Mystic, including cabins at Guadalupe and Cypress Lake. Credit: AP

Expansions into a Known Flood Zone

The sad story of Texas Hill Country’s flash flooding at Camp Mystic is an example of how decisions made years ago, seemingly harmless at the time, slowly evolved into catastrophic mistakes. The Camp appealed its flood zone designation to lower insurance and construction costs, and further grow its camp. FEMA approved the appeals based on an outdated decision structure. Kerr County allowed expansion of Mystic’s successful camp without interference. All parties followed relatively conventional thinking for the time.

However, laissez-faire decision culture about land use, previously conventional, is now obsolete and dangerous. The warmer world we live in is now also more informed about the consequences of this warming, and where those consequences will occur. “Once in a lifetime” events now occur every decade, every year, every month. Previously safe areas are becoming risky, while previously risky areas are becoming life-threatening. In this day and age, governments and jurisdictions allowing development in risky areas should no longer be considered ignorant, but grossly negligent.

Caution against Blindly Following Demand

Escalating climate change is magnifying the dangers of existing geographic hazards. The general public is unaware of, or in denial, about the true extent to which certain geographies have become riskier. Prudent fiduciaries should recognize that smart money will not invest long term solely based on where current demand is, but rather where long-term demand and low climate risk intersect. Investors who fail to strategize with forward-looking climate risk, may find after short term demand dries up and insurance carriers flee, they are left holding permanently devalued assets.

TX-39 in Kerr County, where flood gauge signs are posted at river crossings to notify drivers of how high water levels

Flood Disaster Shows How Cognitive Biases can Distort Risk Perception

Too often, investors allow cognitive biases to affect their investing decisions, instead basing strategy solely on market fundamentals. Allowing biases to influence investing decisions can lead to clouded judgement, downplayed risks, and costly mistakes. The following are examples of biases both residents and investors in Texas may have fallen victim to.

Normalcy Bias

Residents and investors alike may erroneously assume that historical weather patterns will continue into the future, despite a multitude of evidence supporting a changing climate. Kerr County officials claimed the region had never seen a flash flood like that on July 4th before. Likewise, residents whose homes washed away shared the same sentiment, one resident who lost her home shared this sentiment: “We’ve been here 13 years. We’ve experienced some floods in the area but even when that happened, we never had more than some water in a corner of the yard. It never got anywhere near the house.” The area’s drought conditions may also have exacerbated normalcy bias, as normally the primary concern in a drought is water scarcity, not increased flood risk.

Overconfidence Bias

It’s human nature to overestimate one’s own knowledge or ability to predict outcomes. Camp Mystic, established in the 1930, had been in the area since then and knew of the area’s propensity to flood, including advocating in the past for a Guadalupe River flood warning system with sirens. Despite this knowledge, the Camp still decided to appeal FEMA flood maps and even expanded further into the 100-year floodplain. Their actions and long tenure indicate the Camp staff may have been overconfident in their belief that they could safely handle the risk.

Recency Bias

Recent positive performance of a specific area could mislead investors into believing past trends will continue indefinitely, ignoring other macroeconomic factors or long-term risks. During the covid pandemic, massive migration to the metro areas of Texas made the Lone Star State a red-hot place to invest in real estate. Now, the pandemic migration frenzy has slowed considerably, with Dallas, Houston, Fort Worth, and San Antonio all on the top 10 list for net domestic migration declines.

Confirmation Bias

Confirmation Bias can cause investors to focus only on an asset’s positive aspects while ignoring important headwinds. When confronted with an investing opportunity like the Lone Star State, they may subconsciously focus solely on positives like job growth, low taxes, and migration trends. Meanwhile, they dismiss long term issues which are counter to their upbeat sentiment, like increasing floods and severe convective storms, lacking infrastructure, and increasing insurance costs. To fall prey to this bias and only consume information supporting their views calls into question whether the strategy is investing or gambling.

Herd Mentality

Watching peer investors enter a market yielding great returns can cause others to follow, oftentimes without doing their own independent analysis of the asset. Witnessing others’ success can catalyze impulsive behavior and cause FOMO investing, egged on by a false sense of security based on others’ short term successes. Property values in Texas soared during pandemic years, boosted by remote work Americans looking for more space, lower taxes, and cheaper properties. However, this trend and the subsequent surge in home-building now faces major headwinds as home sales slow, inventory balloons and prices have fallen. For example, in Austin, prices have fallen over 20% from their recent peak. Any investors who followed the herd into Texas are now committed to greater climate risks, increasing insurance premiums, and stagnating market demand.

Consider the Message Insurance is Sending You

Insurance is not simply a P&L expense item; it is partly a direct reflection of your property’s risk profile. The public perception of the insurance industry, and property insurers in particular, is often that of a profit-driven, untrustworthy culture which prioritizes money over people, seeks to deny claims, and levy unfair premiums. While these concerns aren't entirely unfounded, it also overlooks an important reality: property insurance companies are primary financial managers of physical risk. As climate change has dramatically increased threats to physical assets, rising insurance premiums may signal more than profit-seeking behavior - they may instead serve as a warning signal. To dismiss premium increases as a purely profit-driven action is to miss an important message about the true vulnerability of your asset and its location.

Flood insurance, which is separate from traditional home insurance, is closely correlated to FEMA’s flood map designations, and is primarily issued by the federal government through the National Flood Insurance Program (NFIP). In 2022, 86% of written flood insurance policies were through NFIP, although policies by private carriers are also growing.

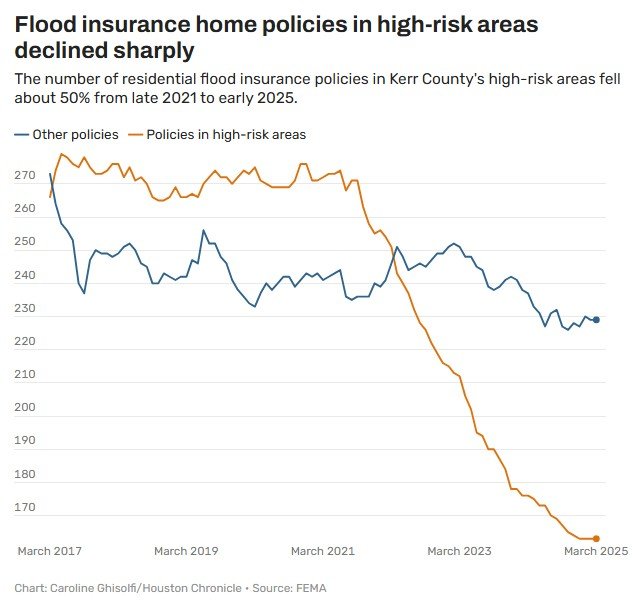

According to the Houston Chronicle, in 2021 FEMA implemented a pricing model update, which increased accuracy of risk capture but subsequently increased the costs of high risk policies. The reaction in Kerr County was violent - in lower risk areas, the drop was marginal, but in high risk flood areas, flood insurance policies dropped by 50% in about 3 and a half years. Despite increasing flood risks nationwide, the adoption of flood insurance remains low. In Kerr County, it’s less than 2.2%, statewide, it’s about 7%. Surviving homeowners who lost their homes and had no flood insurance now need to restart their lives from scratch.

An investigation by the Houston Chronicle found that after a 2021 pricing model update, flood insurance policies dropped by over 50% in the highest risk area

As the climate changes and water bodies like the Atlantic Ocean and Gulf of Mexico (or Gulf of America) get increasingly warmer, floods and storms in Texas and surrounding states are projected to intensify. Texas climatologist John Nielsen-Gammon wrote in a 2024 report that “extreme one day precipitation [in Texas] has increased by 5% to 15% since the latter part of the 20th century” in the region. By 2036, Nielsen-Gammon expects rainfall intensity to increase by an additional 10%. Areas in Texas vulnerable to increasing floods and storms may eventually fall into the stranded asset cycle, where climate risks and challenges can no longer overcome the incumbent financial and tax advantages, eroding demand.

Lone Star Stranded Asset Cycle

Escalating climate risk in Texas due to severe convective storms, hurricanes, and increased flooding can cause the following reactions.

Insurers continue to increase premiums, deductibles, or pull out of the area altogether

Lenders become wary of investing in such areas or demand higher equities

Governments are forced to further protect themselves, by raising taxes or bonds

When any combination of these three reactions occur, eventually businesses and residents are unable to sustain themselves under the burden of insurance, taxes, and losses. An exodus could cause investments to lose value in a permanent manner that may not rebound. Any long term strategies seeing only positive indicators like job growth and low taxes should be wary of long term climate risk as well and the asset’s susceptibility to fall into the Stranded Asset Cycle.

Conclusion

This tragedy is unimaginable for those who have lost their family, their friends, or their homes. Nevertheless, simply conceding that the flash floods were “an act of God” and nothing could have been done is unwise and misguided. The area was already known to flood, as evidenced by floods in 1987 and discussions in 2016 regarding an alarm system. Flood maps designating properties in the flood plain were acknowledged and appealed. Clearly, some of the flood risk was already recognized.

Could biases have played a part in the disaster? Ironically, the people most familiar with the area may have been the most vulnerable. Their past experiences with the area’s floods may have prevented them from acting more cautiously in the face of increasing climate risks. Increases in flood insurance requirements and prices may also have been missed signals that the Texas Hill Country had become riskier. Investors should be careful to not repeat the same mistakes, and consider all aspects of an asset prior to investing, including the future implications of escalating climate events.

Insight: Lessons in Expansion from Texas Hill Country

Insights

-

Stranded Asset Risk, Valuation, and Climate

Tail risks from climate change are increasing for real estate investors

-

Citadel's New Home in South Florida

A billionaire plants roots at the edge of danger in Miami

-

Levees and Levies in Foster City

A master planned community takes on the rising seas