Thesis

How we seek outsize real estate investment returns:

Long term capital commitments in growing regional markets with barriers to entry and resilience to economic and climate risks.

Target less efficient sectors within these growing regional markets.

Leverage tax advantages with long term perspective.

Miami Brickell district with rendering of the proposed Citadel Tower, Credit: Citadel

The Market is Moving on Climate Risk

As climate risks like flooding, wildfires, and drought reshape the real estate landscape, investors are rethinking long-term value. Investment strategies that fail to adapt face rising insurance costs, economic underperformance, and may become stranded altogether.

At Columbia Gorge Capital, we actively screen for assets with long-term climate resilience. Our strategy focuses on regions with lower exposure to sea level rise, wildfire, and other natural hazards.

Notably, the Pacific Northwest is recognized by scientists as one of the more climate-stable regions in North America — an advantage we strategically leverage to deliver durable value over the coming decades.

Healthy, Sustainable Real Estate

Pollinator friendly Landscaping

Housing over Parking

Mental Health Forward Communities

Will Your Assets Be Underwater?

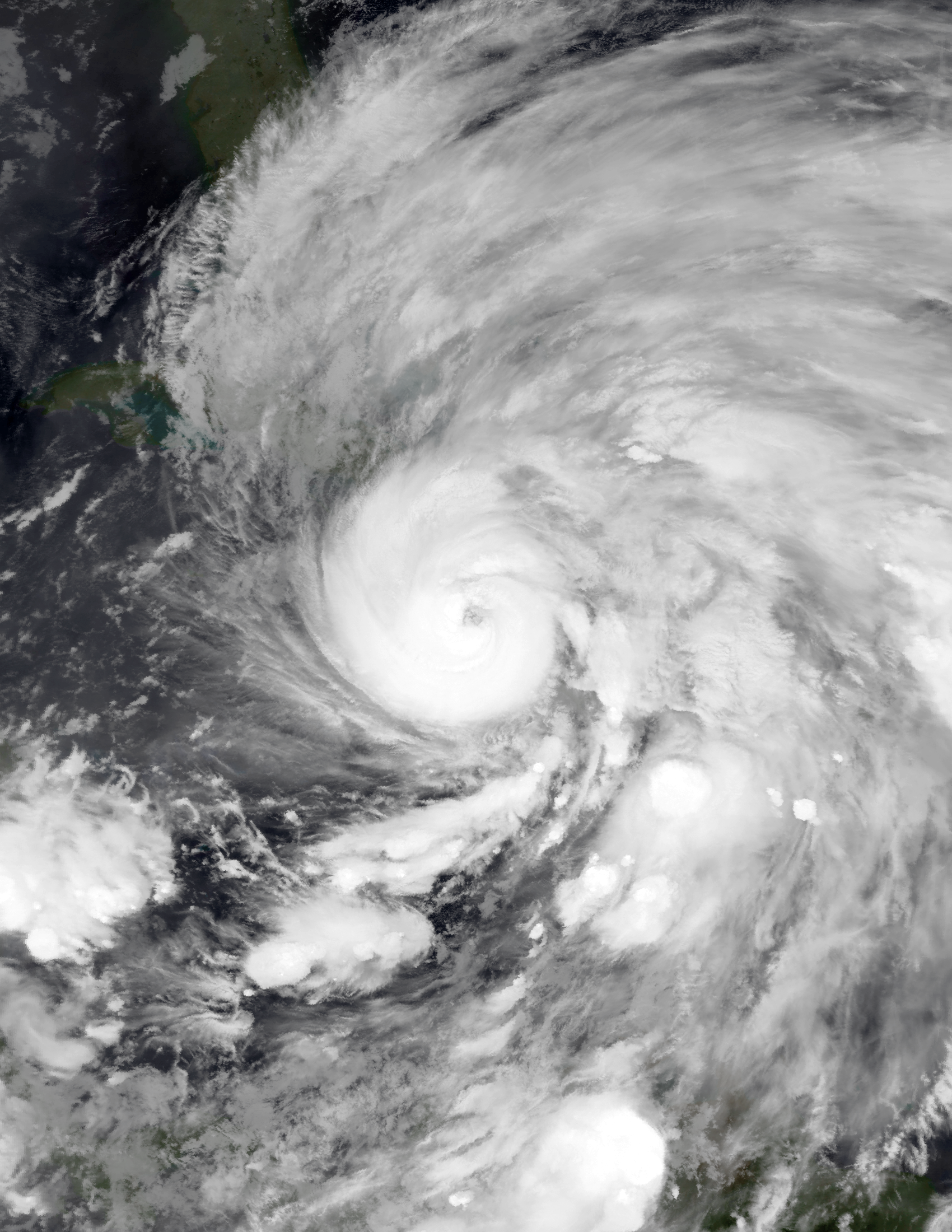

Sea Level Rise: Predictable Risk with Unpriced Consequences

Rising sea levels present clear and quantifiable climate risks. Insurance markets have begun to respond — but real estate prices are still catching up.

We anticipate key inflection points ahead:

Waterfront properties may lose value steeply after severe floods lead to insurance repricing.

As residents and businesses migrate to safer areas, revenues will shrink in the risky areas they leave behind — while their infrastructure demands and civic costs rise.

Our investment approach avoids these high-risk zones, focusing instead on climate-stable regions where long-term value is more secure.

Will Your Assets Be Covered?

Wildfire Risk Is Rising — So Are Insurance Costs

As climate change fuels longer and more intense wildfire seasons, real estate faces growing financial threats.

Can your assets still be insured? Is your state’s insurance market holding up? What is the probability that the insurance companies will drop coverage of your assets? What will your lender do? Can you afford the necessary upgrades?

And beyond property — can residents safely breathe the air?

We prioritize investments in regions with lower wildfire exposure and resilient insurance markets.

Will Your Assets Be Left Behind?

Stranded Assets: When Business Models Break Down

Some regions are beholden to a single industry, leaving them vulnerable in the event of sector decline.

What happens to your assets when revenues fall or costs rise permanently? Can the local economy — and your investment — still thrive?

We assess economic resilience to avoid stranded assets and ensure long-term viability in our portfolio.

Join Us

©2025 Columbia Gorge Capital